You know that uneasy feeling when you’re checking your online banking app at a café or airport Wi-Fi? Your instinct isn’t wrong, public networks can make online banking riskier, even though your banking app already has its own security layers. That’s why many people turn to a VPN for extra protection: it encrypts your traffic, hides your IP address, and helps keep your online banking safer. In this article, we’ll explore the questions: is vpn safe for online banking, how using a VPN for online banking can actually protect you, when it helps, and when it doesn’t.

Table of Contents

Why Online Banking Security Matters

Online banking saves you a lot of time and hassle; you can move money with just a few taps. The flip side is that any system we rely on this much becomes a target. Attackers are constantly testing bank defenses, and no institution can guarantee 100% safety. That’s why it’s smart to have your own protection in place, instead of relying only on the bank’s built-in security.

Network-Level Threats in Financial Transactions

It’s nothing new that cybercriminals can drain an online bank account in a matter of moments. While phishing, malware, and large-scale data breaches often grab the headlines, there’s also a quieter but very real danger at the network level: especially on public Wi-Fi.

In January 2025, 54-year-old Barbara Turner from Victoria, Australia, discovered that her life savings had been stolen when she logged into her ING banking app. Thousands of dollars she had been saving for a scheduled knee surgery had been drained after she made an online purchase over unsecured Wi-Fi. According to a SPARC report and media coverage, Ms Turner said ING could do little to help beyond 150 Australian dollars, and she later warned others never to shop on open Wi-Fi again.

The travel magazine Vacations & Travel picked up her story in a February 2025 article on public Wi-Fi safety, using it as a real-world example of how an insecure network can lead directly to accessing bank accounts.

We still don’t know the exact technical method used in Ms Turner’s case, but security experts warn that on open or poorly secured unsecure Wi-Fi, attackers can intercept login credentials and payment data using techniques like evil twin attacks, where a fake network impersonates a legitimate café or airport hotspot to trick users into connecting. In scenarios like the 2025 Australian unsecure Wi-Fi banking scam, a properly configured VPN would have made it significantly harder for anyone on the local network to read or tamper with online banking traffic.

Can a VPN Protect Your Online Banking Data

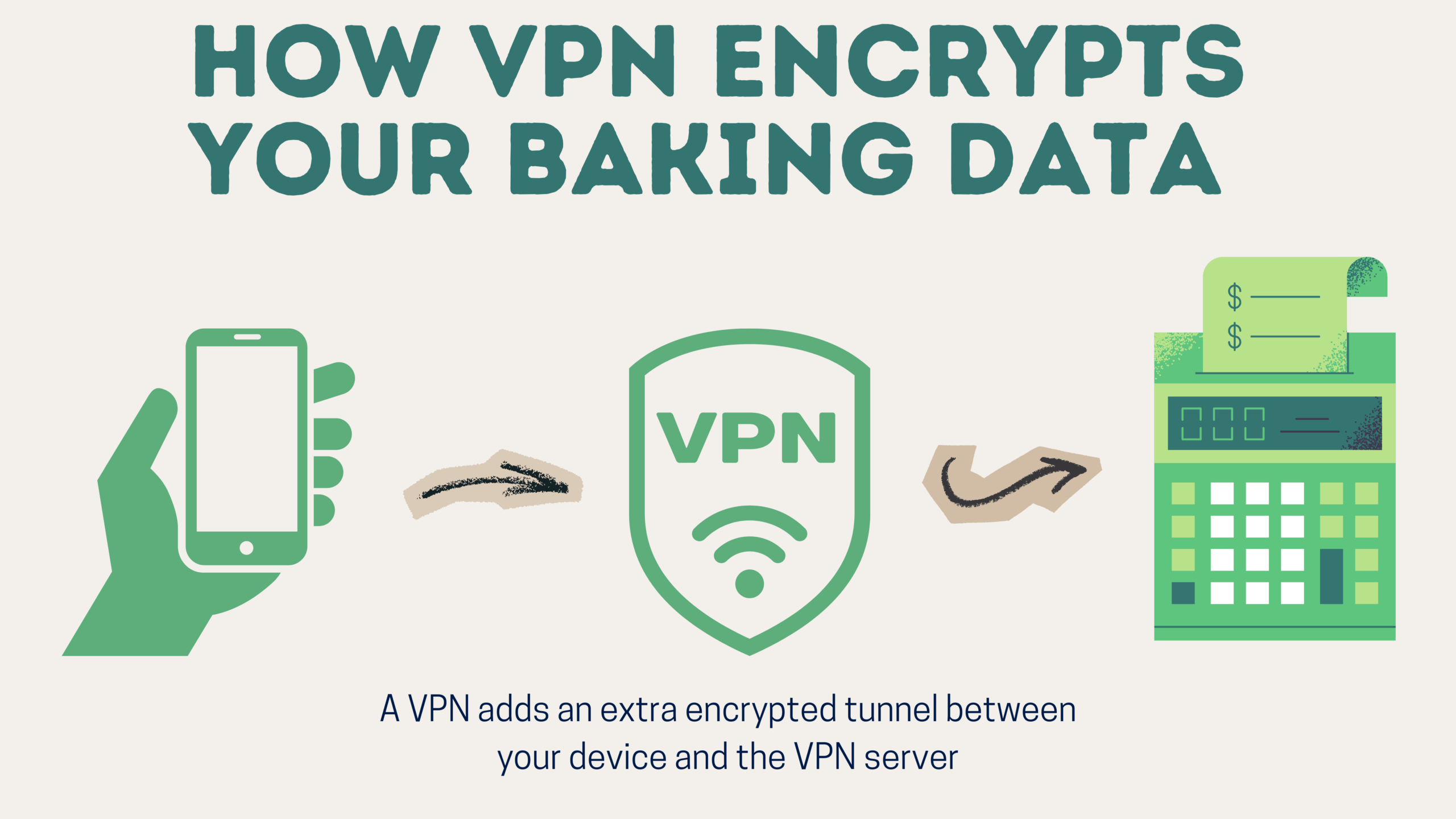

A VPN (Virtual Private Network) is a tool that encrypts your internet traffic, making it more secure when accessing online banking accounts. When you connect through a VPN, your banking data is wrapped in an encrypted tunnel between your device and the VPN server, which helps protect it from attackers on the local network. This gives you an extra layer of protection, especially when you’re connecting from public or unsecure Wi-Fi.

How VPN Encrypts Your Banking Data

Even when your bank uses HTTPS/TLS, your connection still has to pass through the local network and your Internet service provider (ISP). On a public or untrusted Wi-Fi, someone with the right tools can try to interfere with that path.

A VPN adds an extra encrypted tunnel between your device and the VPN server. Instead of your banking traffic travelling in readable form over the local network, it’s wrapped in strong VPN encryption. Anyone trying to snoop on the Wi-Fi will only see random ciphertext, not your actual login details.

Do VPN and Bank Security Measures Conflict

If your banking app uses fraud detection, a login from a masked VPN IP address, especially from a different country or a shared data-center IP, can look suspicious, so you may be asked to complete extra verification. Some banks, like BoA, Citi, HSBC, or Wells Fargo, even detect and restrict connections from known VPN ranges, occasionally blocking those logins altogether.

However, a VPN does not weaken your bank’s own HTTPS encryption or its password and multifactor authentication systems. It simply adds another encrypted layer between your device and the internet. That added layer can significantly improve the security of your financial transactions on public or untrusted networks, even if it sometimes triggers additional fraud checks.

Does Using a VPN Make Your Transactions Safer

Yes. Like the case mentioned before, using a VPN can significantly improve the safety of your online banking by adding an added security of encryption, which makes it much harder for cybercriminals to read or misuse any data they intercept. At home, a VPN can enhance your banking privacy and security by masking your real IP address and encrypting your entire connection on top of your bank’s own HTTPS protection. At a hotel or café on unsecure Wi-Fi, a VPN is even more important because it protects your banking traffic from hackers on the local network who might otherwise try to spy on or tamper with your connection.

Can You Use a Free VPN to Protect Your Online Banking Data

Yes. Although many reports show that a large share of free VPN apps use weak encryption or monetize user data, X-VPN is designed to avoid these common risks.

X-VPN’s free plan secures every connection with AES-256 encryption, the same algorithm widely used by banks and government agencies, and runs on a fully RAM-only server network, so no traffic is written to disk. You can verify how this works in practice in X-VPN’s public Transparency Report, which shows zero user-data disclosures since 2017. Unlike many services, X-VPN’s free tier doesn’t require your email address or payment details, you can start using it without registration.

How to Set Up a VPN for Online Banking

Step 1: Install the VPN on Your Device

First, install a trustworthy and secure VPN on your device. X-VPN is a strong option: it runs over 10,000 servers in more than 80 countries and is upgrading many of them to 10 Gbps bandwidth for ultra-fast connections. X-VPN also uses AES-256 encryption on a RAM-only server infrastructure, which means your data is processed in memory instead of being written to disk. AES-256 is the same encryption standard widely used by banks and other financial institutions to protect sensitive financial data. Together, these features give you a fast, privacy-focused connection. It’s well-suited to sensitive tasks like logging in to your bank and making transfers, whether you’re at home or on the road.

Step 2: Connect to a Suitable Server Location

Next, open the VPN app and choose a secure server location. For the best performance, pick a server that’s close to your real location. If you’re traveling, you can also connect to a server in your home country. That way, your bank is less likely to flag the login as coming from an unusual location. X-VPN’s large server map makes it easy to find a nearby or home-country server that works for you.

Step 3: Log In to Your Bank and Verify the Connection

Once the VPN is connected, you can quickly double-check that it’s working by using X-VPN’s free IP Address Checker to see whether your IP address now matches your chosen server. After that, open your online banking app or website and log in as usual, and make sure pages load normally. With the VPN tunnel active, your banking traffic is better protected against snooping on local networks, giving you a smoother and safer online banking experience.

How to Access to Online Banking App If You Got Blocked

Remember how we mentioned that banking apps use fraud detection and risk-based security? Sometimes, that’s exactly why your login gets blocked when you’re connecting from a masked VPN IP address. Many banks treat VPN or data-center IPs as suspicious and either ask for extra verification or simply refuse the connection to protect your account. The good news is that there are safer ways to work around this without giving up security completely.

You can use X-VPN’s split tunneling feature to let your online banking app bypass the VPN while keeping other apps protected. In practice, that means you tell X-VPN not to route your banking app’s traffic through the VPN tunnel, while your browser, email, or other apps still use the VPN as normal. Once you’ve logged in and finished any sensitive actions, you can add the banking app back to the “Via VPN” list, so its traffic is encrypted again.

If your VPN provider offers a static or dedicated IP address, using it for online banking can also help. Instead of logging in from a constantly changing pool of shared VPN IPs, you get a consistent IP that your bank can learn to recognize over time. This reduces the chance of your logins being flagged as suspicious and makes the whole process smoother, especially if you bank from multiple locations or travel frequently.

When Should You Use a VPN for Online Banking

As mentioned earlier, your bank account can be compromised very quickly if an attacker manages to hijack your connection or steal your login details. That’s why it’s a necessary step to use a VPN for online banking in the following situations.

Accessing Online Banking on Public Wi-Fi

- First of all, many people check their balance or make transfers while connected to public Wi-Fi, at cafés, airports, hotels, and other crowded places. It’s easy to assume that open Wi-Fi is “good enough” and that your banking app will handle all the security and encryption for you. But if a cybercriminal is targeting that network, things can go wrong very quickly.

Attackers can set up a fake hotspot with a legitimate-sounding name, like “Free Airport Wi-Fi” or “CDG-5G-HotSpot”, and trick you into connecting. They can also use packet-sniffing tools or Man-In-The-Middle techniques to intercept unprotected traffic on the network and try to capture your login details.

When you use a VPN, your online banking traffic is encrypted inside a secure tunnel between your device and the VPN server. That makes it much harder for anyone on the same open Wi-Fi network to read or tamper with your data, a valuable extra layer of protection on top of your bank’s own security.

Accessing an Online Banking Account while Traveling Abroad

- When you travel abroad, it’s normal to need your banking app: to check your balance, pay a bill, or move money between accounts. However, logging in from a new country can sometimes trigger your bank’s fraud detection systems. Some banks may ask for extra verification or even temporarily block access if they see a login from an unusual location, because they’re trying to protect you from account takeover.

A VPN can help in two ways when you’re overseas. First, connecting to a VPN server in your home country can sometimes reduce the chance of your login being flagged as suspicious. Second, it encrypts your connection on hotel, airport, or restaurant networks, making it much harder for anyone on the local network to snoop on your banking traffic.

Accessing an Online Banking Account From an Unsecured Network

- On a shared network in your office, dorm, or rental place, you never really know who else is on it or how safely the router is configured, anyone on the local network could potentially peek at or tamper with unprotected traffic. Running a VPN here wraps your banking session in encryption, keeping what you do inside your app private from everyone sharing that connection.

The same goes for mobile hotspots. Cellular networks are generally safer than open Wi-Fi, but they can still be exposed to tracking and surveillance, so using a VPN adds an extra layer of privacy and security for your online banking wherever you connect.

When a VPN May Not Be Enough For Online Banking

A VPN can greatly improve the safety of your online banking, especially on insecure networks. But it isn’t a magic shield. There are some situations where a VPN can’t protect you, or where it may even cause issues. Here are a few common cases to watch out for.

If Your Bank Blocks VPN Traffic

- Some banks block or restrict logins from known VPN servers because they treat these IP addresses as high risk. In practice, that can mean sudden disconnections, failed logins or transactions that won’t go through.

You can temporarily disconnect the VPN or use split tunneling so that only your banking app bypasses the VPN, while your other apps stay protected. On public or unsecured Wi-Fi, however, it’s safer to switch to mobile data rather than letting your banking app connect without any protection on that network.

If You Use an Untrustworthy VPN

- A bad VPN can be worse than no VPN at all. Many shady VPNs make money by logging your activity and selling data such as browsing history, device details, and connection metadata to advertisers or data brokers. In the worst cases, researchers have found VPN apps and extensions that secretly capture screenshots or inject tracking code into the pages you visit.

This completely undermines the privacy you expect when accessing your bank. To stay safe, stick to VPN providers with a clear transparency report, a strict no-logs policy, rather than random VPN apps you’ve never heard of.

If You Change VPN Locations Constantly

- Risk-based fraud systems at banks look for unusual patterns, including sudden changes in IP address or country. If you keep switching VPN servers, especially between different regions, your bank may see a series of logins from multiple locations in a short period and treat that as suspicious. That can lead to extra verification prompts or, in some cases, temporary account restrictions.

For online banking, it’s better to choose one trusted server and stick to it instead of hopping between locations.

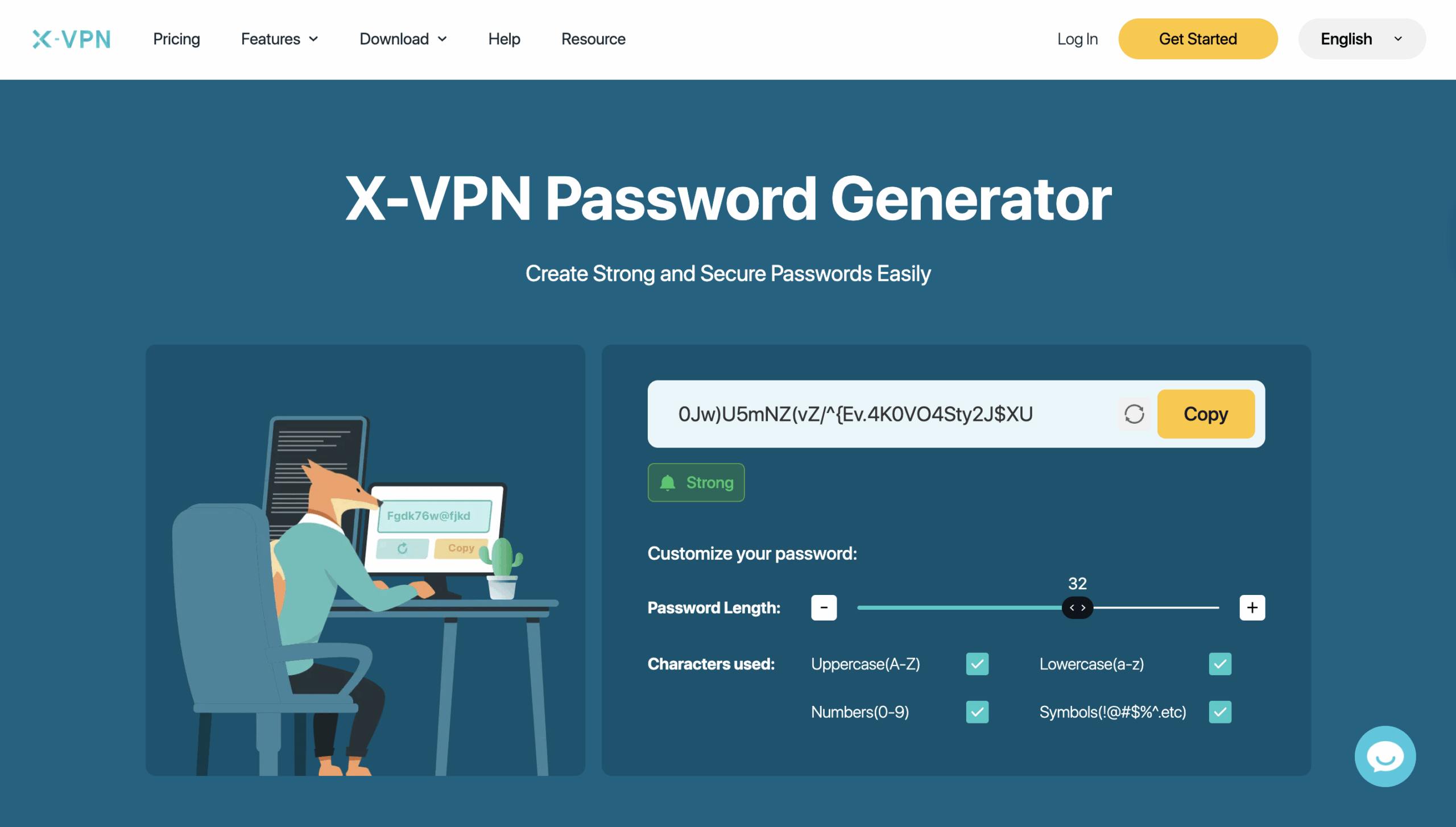

If You Don’t Use Strong, Unique Passwords

- A VPN can’t save a weak password. If your online banking password is something simple like “123456”, your name or your birthday, attackers can guess or brute-force it very quickly with or without a VPN in place.

To truly protect your account, you need a strong, unique password that you don’t reuse anywhere else, plus two-factor authentication where your bank supports it. Using a password generator makes this much easier than trying to invent and remember complex passwords by yourself.

If You Enter Your Banking Details on a Fake Site

- A VPN can’t protect you if you hand your credentials straight to a scammer. If you’re tricked into visiting a phishing page that looks like your bank’s website, and you type in your username, password, and one-time codes, the attacker can use those details to take over your account, even if the connection itself is encrypted.

Always double-check the URL before logging in, use bookmarks or your bank’s official app instead of links in emails, and avoid clicking on pop-up ads or random “login” buttons on shopping and social sites.

If Your Device Has Malware or a Keylogger

- A VPN protects data in transit, it doesn’t protect a device that’s already compromised. If your phone or computer is infected with banking malware or a keylogger, every keystroke you type (including your banking login and one-time codes) can be recorded and sent to the attacker before it even goes into the encrypted VPN tunnel.

That means your bank account details are effectively exposed, regardless of whether you use a VPN. Regularly update your operating system and apps, avoid pirated or sideloaded software, run reputable security tools where appropriate, and never ignore warnings about suspicious apps or browser extensions.

Wrap It Up

Online banking safety is more important than ever for anyone who manages money online. To better protect your finances from scams and cyber threats, you need strong security habits along with the right tools, from unique passwords and multifactor authentication to keeping your devices clean and using a trustworthy VPN on public or unsecured networks.

FAQ

Why does my bank block VPN connections?

Most banks block or flag VPN connections because they look “high-risk” to their fraud-detection systems. VPN IPs are often shared by many users and are also used by scammers to hide their real location, so some banks either reject them outright or require extra verification to reduce the chance of account takeover.

Will using a VPN slow down my banking transactions?

Yes, a VPN can slow your connection a bit because your data is encrypted and routed through an extra server, but with a good VPN and a nearby server, the slowdown is usually small and barely noticeable for light tasks like checking balances or moving money. In some cases, a VPN can even help if your ISP is throttling certain traffic.

Is it legal to use a VPN for banking?

Yes, in most countries it is legal to use a VPN for online banking, including the US, UK, EU, Canada, and Australia. A few countries restrict or ban VPNs, so if you’re travelling, you should always check local laws and your bank’s terms of service.

What should I do if my bank locks me out when using a VPN?

If your bank locks you out while you’re on a VPN, first try reconnecting on a trusted network (like your home Wi-Fi) and either disconnect the VPN or use split tunneling, so only the banking app bypasses it. If you still can’t log in, switch to a server in your home country and contact your bank’s support to verify your identity instead of trying risky “workarounds.”

Is online banking safe without a VPN?

It depends. Online banking can be safe without a VPN if you use your bank’s official app or HTTPS website on a trusted network, with strong, unique passwords and multifactor authentication. However, on public or unsecured Wi-Fi, your risk is much higher, so a VPN becomes an important added layer of protection.

Is it safe to use public Wi-Fi with a VPN for banking?

Using a reputable VPN on unsecure Wi-Fi is much safer than banking on open Wi-Fi without one, and many security experts specifically recommend this setup because the VPN encrypts your traffic and helps block local snooping. It still isn’t 100% protection, so you should also check for HTTPS, use your bank’s official app, avoid suspicious links, and keep your device free of malware.